Insurance Meaning and Types

Insurance is a critical aspect of financial planning, providing protection and peace of mind against unexpected events. In this comprehensive guide, we’ll delve into the meaning of insurance, explore its various types, understand how insurance works, and discuss the importance of having adequate coverage.

Introduction to Insurance

Insurance is essentially a contract between an individual or entity and an insurance company. The individual, known as the insured, pays a premium in exchange for financial protection against specified risks. These risks could include damage to property, loss of income, medical expenses, or even death.

Understanding the Meaning of Insurance

At its core, insurance is a risk management tool. It allows individuals and businesses to transfer the financial consequences of certain risks to an insurance company. In return for this transfer of risk, the insured pays a premium, which is typically a recurring payment made monthly, quarterly, or annually.

Importance of Insurance

Insurance plays a crucial role in safeguarding individuals and businesses against financial hardship caused by unexpected events. It provides a safety net, ensuring that people can recover financially from accidents, illnesses, natural disasters, or other unforeseen circumstances without facing crippling expenses.

Types of Insurance

Life Insurance

Life insurance provides a payout to beneficiaries in the event of the insured’s death. It helps provide financial support to dependents and cover expenses such as funeral costs, mortgage payments, and outstanding debts.

Health Insurance

Health insurance covers medical expenses incurred due to illness or injury. It includes benefits such as doctor visits, hospitalization, prescription medications, and preventive care.

Auto Insurance

Auto insurance protects against financial losses resulting from accidents, theft, or damage to vehicles. It typically includes coverage for liability, collision, comprehensive, and uninsured/underinsured motorists.

Home Insurance

Home insurance safeguards homeowners against property damage and liability risks. It covers losses caused by fire, theft, vandalism, natural disasters, and accidents on the property.

Travel Insurance

Travel insurance provides coverage for unexpected events while traveling, such as trip cancellations, medical emergencies, lost luggage, or travel delays.

Business Insurance

Business insurance offers protection to businesses against various risks, including property damage, liability claims, employee injuries, and business interruption.

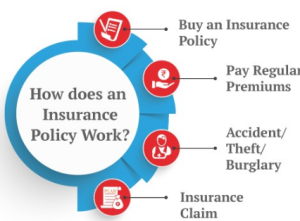

How Insurance Works

Insurance operates on the principle of risk pooling. Policyholders contribute premiums into a pool, which the insurance company uses to pay out claims when covered events occur. The amount of premium paid is based on the likelihood of the insured event happening and the potential financial impact of that event.

Factors to Consider Before Choosing Insurance

Before purchasing insurance, it’s essential to assess your needs, evaluate different coverage options, and consider factors such as cost, coverage limits, deductibles, and exclusions. Additionally, researching the reputation and financial stability of insurance companies can help ensure reliable coverage.

Benefits of Having Insurance

Having adequate insurance offers numerous benefits, including financial protection, peace of mind, security for loved ones, and the ability to recover from unexpected setbacks more quickly.

Common Misconceptions About Insurance

Despite its importance, insurance is often misunderstood. Common misconceptions include the belief that insurance is unnecessary if you’re young and healthy, or that all insurance policies are the same. It’s crucial to debunk these myths and educate individuals on the importance of proper coverage.

Tips for Finding the Right Insurance

To find the right insurance policy, consider working with a reputable insurance agent or broker who can assess your needs and recommend suitable coverage options. Compare quotes from multiple insurers, read policy terms carefully, and ask questions to ensure you understand what is covered and what isn’t.

Conclusion

Insurance is a vital component of financial planning, offering protection and security against life’s uncertainties. By understanding the various types of insurance available and choosing the right coverage for your needs, you can ensure peace of mind and financial stability for yourself and your loved ones.