Cost of Capital and Investment Decisions: The Pulse of Corporate Finance

In the realm of corporate finance, the decision to invest in a new project, acquire a competitor, or develop a new product line is never taken lightly. At the heart of these pivotal choices lies a fundamental metric: the Cost of Capital. It serves as the bridge between a company’s financing activities and its strategic […]

Mastering the Unpredictable: A Comprehensive Guide to Risk Management in Corporate Finance

In the volatile theater of global commerce, risk is the only constant. For corporate treasurers, CFOs, and financial planners, risk management isn’t just a defensive maneuver—it is a strategic engine that drives value creation. When executed correctly, it transforms uncertainty from a threat into a competitive advantage. This article explores the foundational pillars, sophisticated methodologies, […]

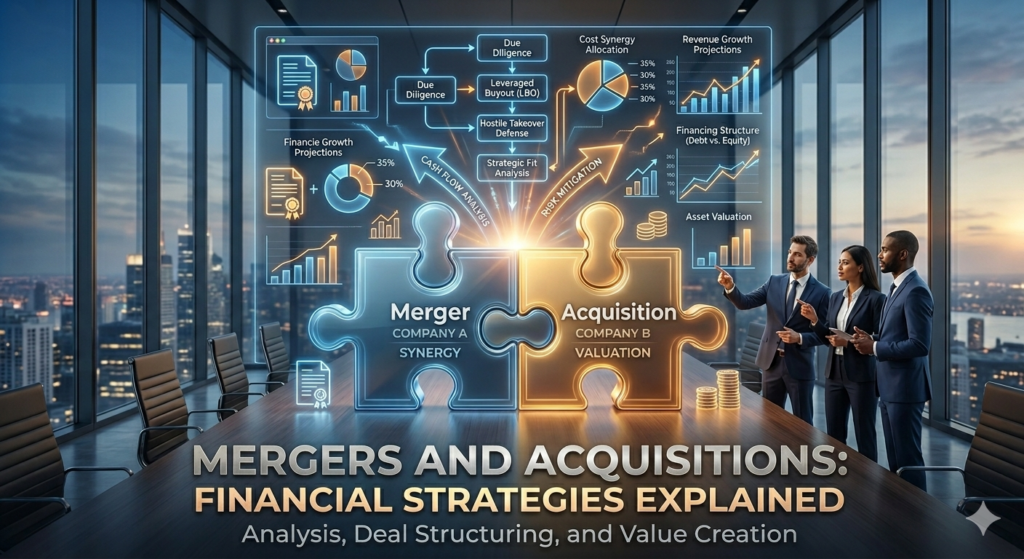

Mergers and Acquisitions: Strategic Financial Frameworks for Corporate Growth

In the modern corporate landscape, Mergers and Acquisitions (M&A) serve as one of the most potent catalysts for transformation. Whether it is a tech startup being absorbed by a silicon valley giant or two industrial titans combining to achieve economies of scale, the financial mechanics behind these deals are complex and high-stakes. Understanding M&A requires […]

The Strategic Engine: The Role of Corporate Finance in Business Growth

In the modern economic landscape, corporate finance is often misunderstood as merely “accounting with a fancier title.” However, while accounting looks backward at what has already happened, corporate finance looks forward at what could happen. It is the strategic engine that drives a company’s trajectory, determining whether a business merely survives or achieves exponential growth. […]

Mastering the Flow: Best Practices for Working Capital Management

In the world of corporate finance, liquidity is the lifeblood of any organization. While high-level strategies often focus on long-term investments and market expansion, the day-to-day survival of a business depends on Working Capital Management (WCM). Working capital is defined by the formula: $$Working\ Capital = Current\ Assets – Current\ Liabilities$$ Effective WCM ensures that […]

Financial Statement Analysis for Corporate Leaders: Beyond the Bottom Line

In the modern corporate landscape, data is often hailed as the new oil. However, for a C-suite executive or a high-level director, the raw data found in financial reports isn’t just information—it’s a narrative. Financial Statement Analysis (FSA) is the art of reading between the lines of balance sheets and income statements to understand a […]

Maximizing Shareholder Value Through Strategic Finance: A Modern Blueprint

In the contemporary corporate landscape, the phrase “maximizing shareholder value” is often misunderstood as a relentless pursuit of short-term profits. However, in the realm of Strategic Finance, it represents a sophisticated, long-term approach to resource allocation, risk management, and capital structure optimization. Strategic finance moves beyond the traditional role of accounting—which looks backward at what […]

Capital Structure Decisions: Finding the Perfect Balance Between Debt and Equity

Choosing how to finance a business is one of the most critical decisions a Chief Financial Officer (CFO) or entrepreneur will ever make. This choice, known as Capital Structure, determines the mix of long-term debt and equity a firm uses to fund its operations and growth. While it might seem like a simple matter of […]

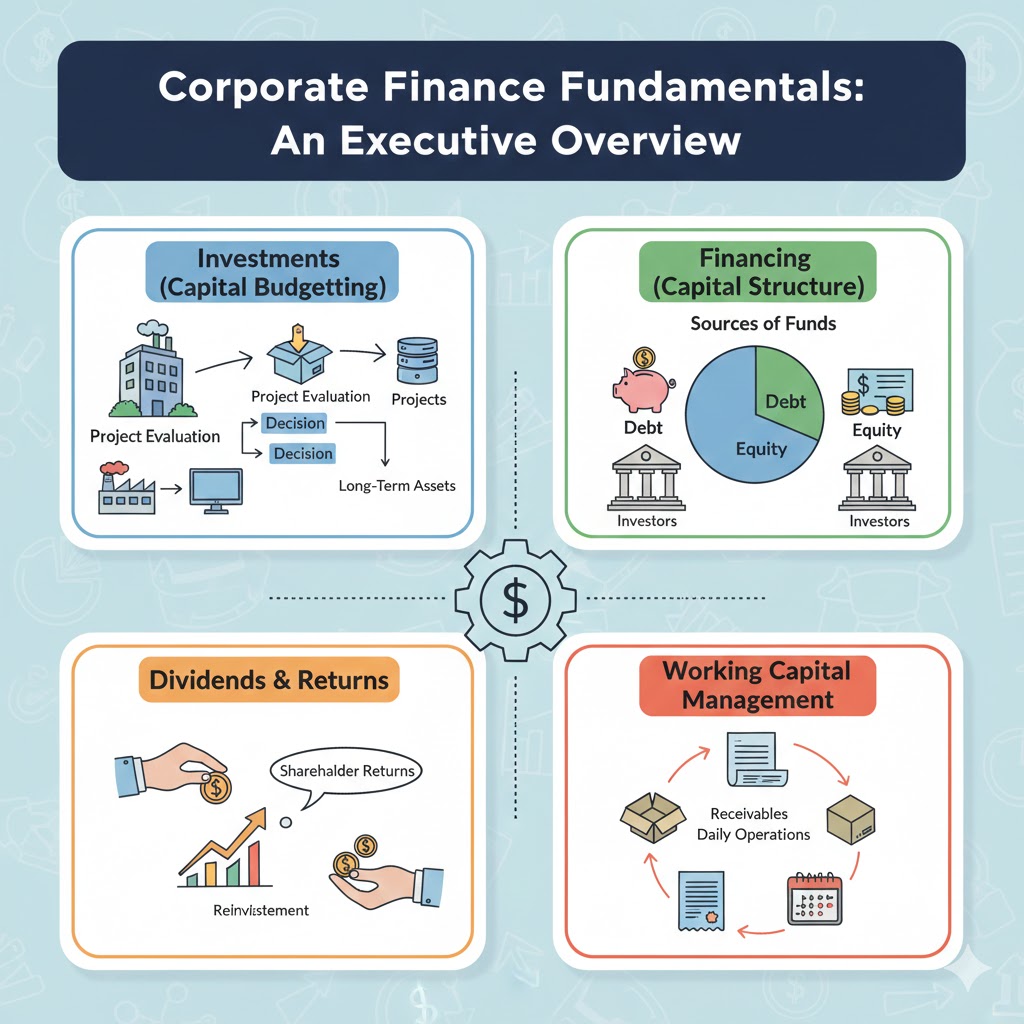

Corporate Finance Fundamentals: An Executive Overview

In the modern business landscape, the role of an executive has evolved far beyond departmental management. Whether you oversee marketing, operations, or technology, a fundamental grasp of corporate finance is the “universal language” that translates strategy into measurable success. Corporate finance is not merely about accounting or balancing books; it is the strategic framework used […]

How to Choose the Right Insurance Policy for Your Needs

Choosing the right insurance policy can feel overwhelming. With so many providers, coverage types, exclusions, and pricing structures, it’s easy to become confused or make a decision based solely on cost. However, insurance is not just a financial product—it’s a long-term protection strategy designed to safeguard your health, assets, income, and loved ones. This guide […]